Measuring performance and ROI from organic channels has always been difficult, messy, and somewhat opaque.

With the advent of generative AI, it’s getting even more challenging – reallocating the value of content, refactoring the customer journey, and changing how marketers must invest and measure their programs.

To learn how marketers currently measure their organic growth programs, and how that is changing in the face of AI search, we surveyed 170 U.S. marketers. On September 13, 2025, we asked 45 questions about SEO metrics, attribution, tools, challenges, and where they plan to invest next.

Download the full report here.

Respondents came from a mix of roles, specialties, company sizes, and industries:

- Roles: 38.2% Managers, 37.6% Individual Contributors, 11.2% Directors, 9.4% Executives, 3.5% Other

- Specialties: 18.8% Brand & Content Marketing, 21.2% Product & Strategy, 19.4% Digital and Growth Marketing, 17.1% Operations & Analytics, 7.1% SEO, 6.5% Other

- Company Sizes: 24.7% less than 50 employees, 22.9% 50-200 employees, 14.7% 201-500 employees, 12.9% 501-1000 employees, 12.9 1001-5000 employees, 11.8% more than 5000 employees

- Industries: 13.5% E-commerce/Retail, 12.9% Technology/SaaS, 11.2% Media and Publishing, 10% Healthcare, 9.4% Financial Services/Fintech, 9.4% Advertising & PR, 7% Professional Services, and the remaining industries represented less than 5% of the population each: Marketing, Entertainment & Events, Travel & Hospitality, Real Estate, and Nonprofits

Executive Summary

- Traditional SEO isn’t dead: Contrary to the doomsday narrative, most teams report stable or increasing core SEO metrics – and trust in those metrics often holds or rises.

- 62.9% of marketers prioritize revenue, conversion rate, and pipeline, yet only 31.8% tie organic growth to value metrics in stakeholder reporting.

- Attribution is complex, and AI makes it darker: Multi‑touch/custom models are popular, but without AI visibility and self‑reported attribution, teams misclassify LLM‑influenced demand as “direct.”

- Satisfaction compounds with capability: As organizations strengthen their AI attribution and commitment to GEO, satisfaction with their overall organic growth strategy grows.

The Steady Ground of Traditional SEO

Across SEO circles, there’s been growing concern about the impact of AI Overviews and other SERP changes on metrics. Multiple industry reports have pointed to a decline in organic click-through rates. For example, Ahrefs analyzed 300,000 keywords in Google Search Console, comparing 2025 data to the prior year, and reported a 34.5% drop in CTR attributed to AI Overviews.

To better understand this, we surveyed teams to compare their real-world experience with the patterns suggested in these industry reports.

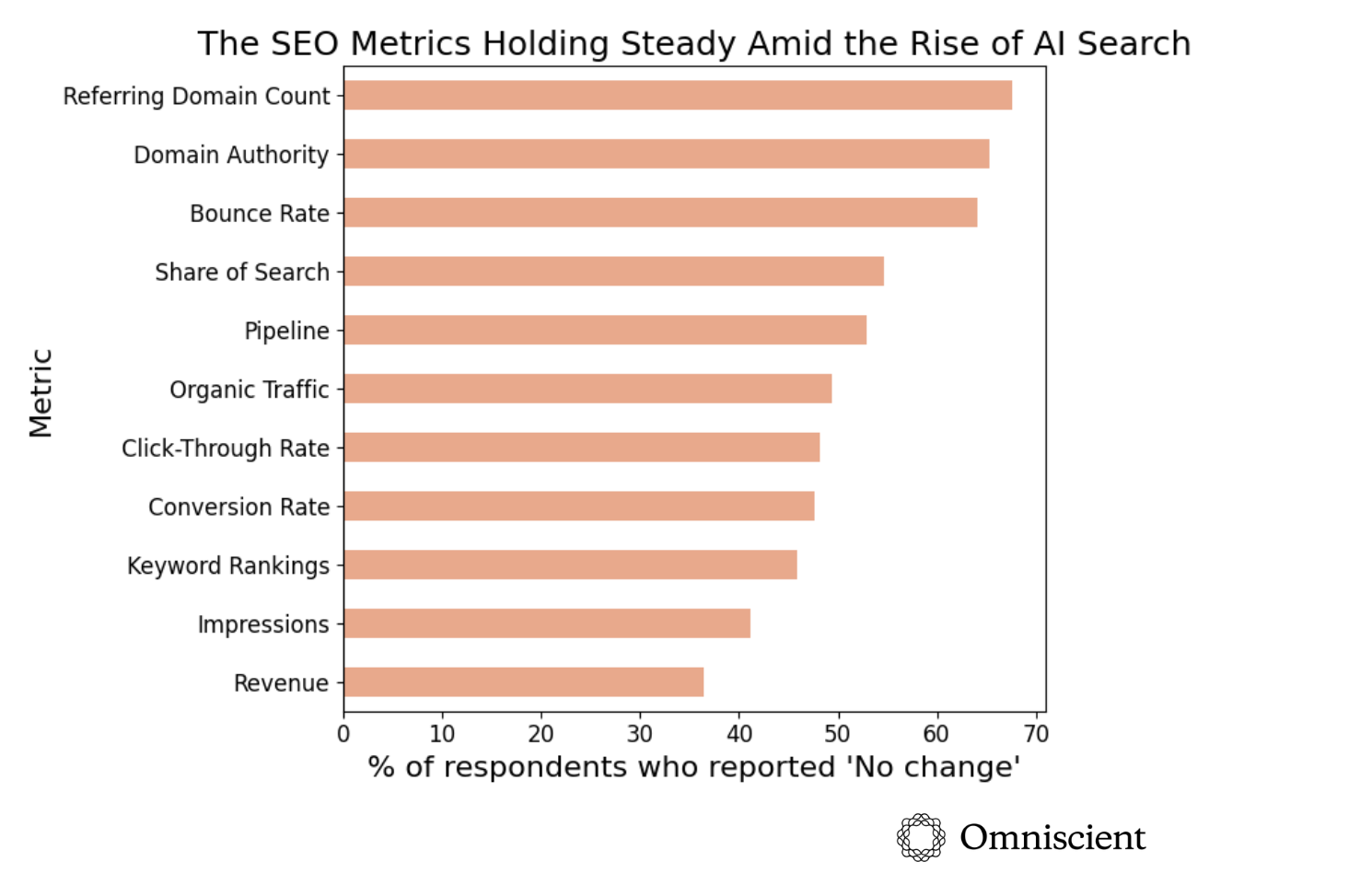

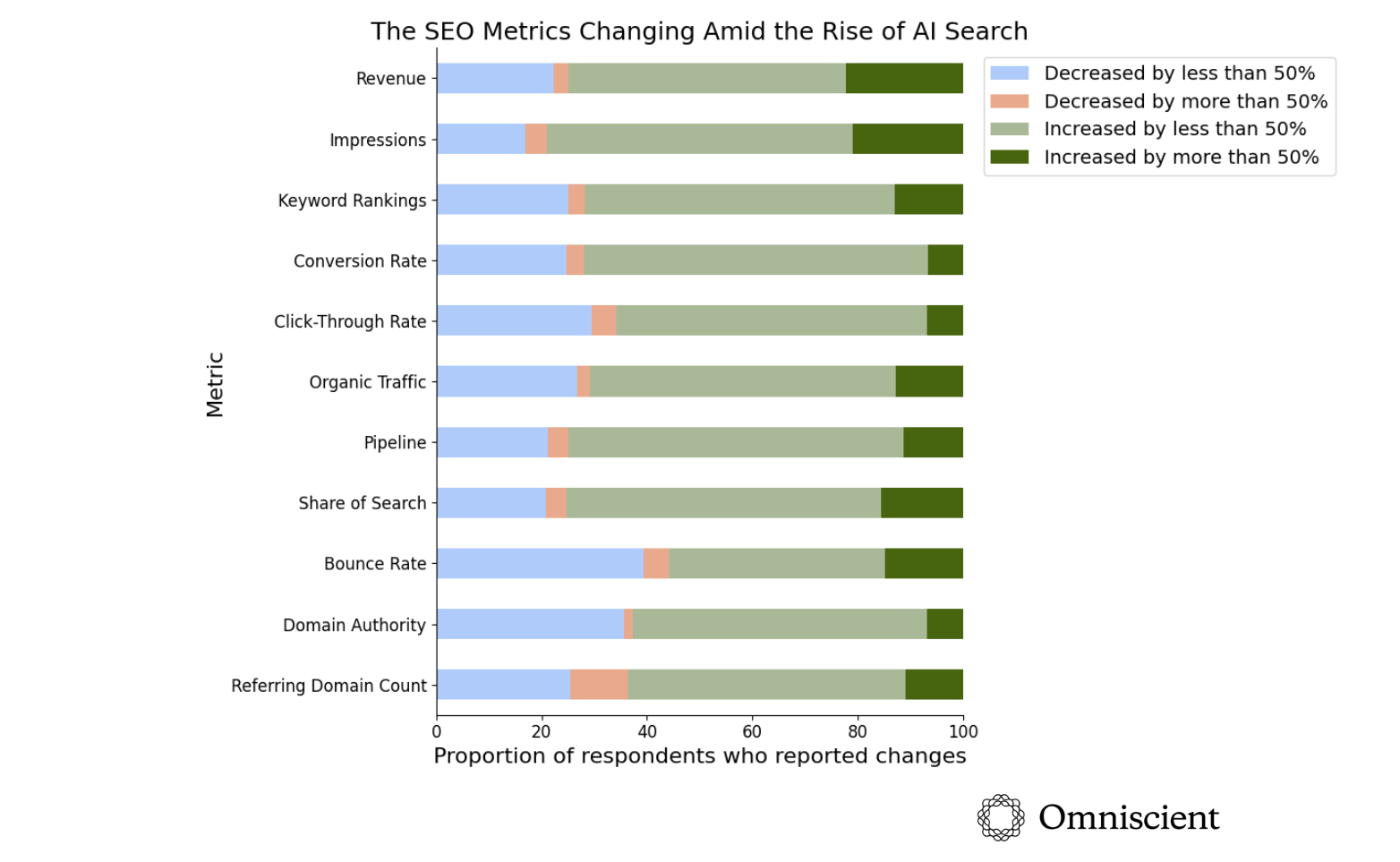

Traditional SEO Metrics are Stable

Among our respondents, across 11 common SEO metrics, 36.5%-67.6% report stability.

Where changes occur, more teams report increases over decreases – and declines are usually modest.

So there’s no SEO apocalypse…yet. Not to mention the interplace of classic SEO methodologies with performance in AI search. Even the classic metrics from search – traffic, clicks, impressions – appear stable (at least in our data set).

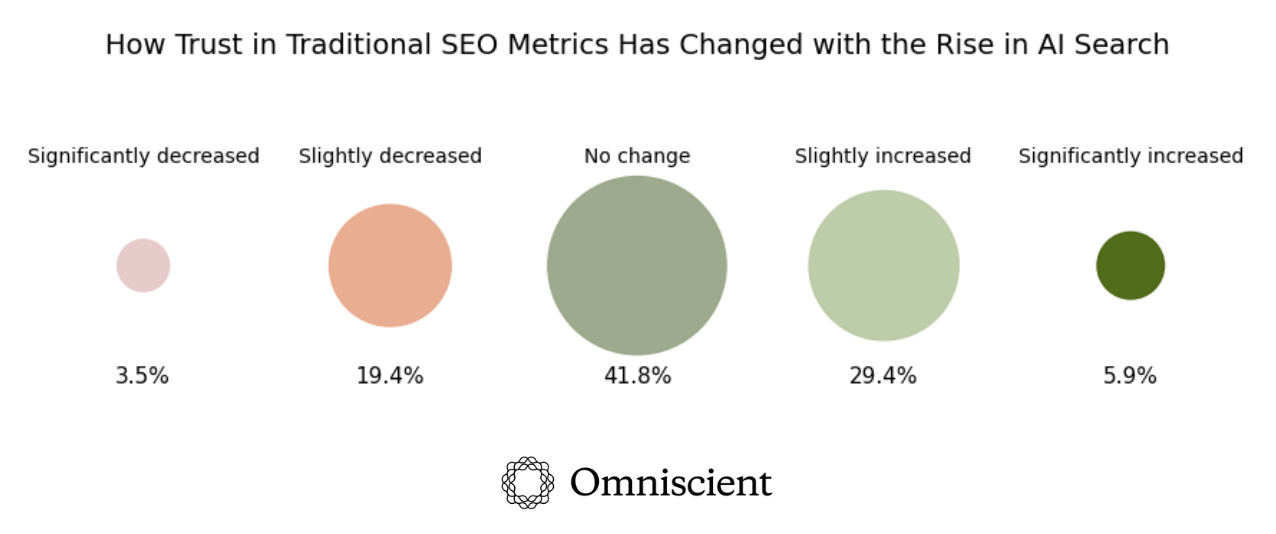

Do people trust these metrics?

Trust is holding up, even rising for many: When asked whether AI Overviews and tools like ChatGPT changed their trust in traditional SEO metrics, the majority said no change; 35.3% reported increased trust while 22.9% reported decreased trust.

Marketers Say Revenue Matters, but Their Reporting Says Otherwise

The metrics marketers assign the highest priority

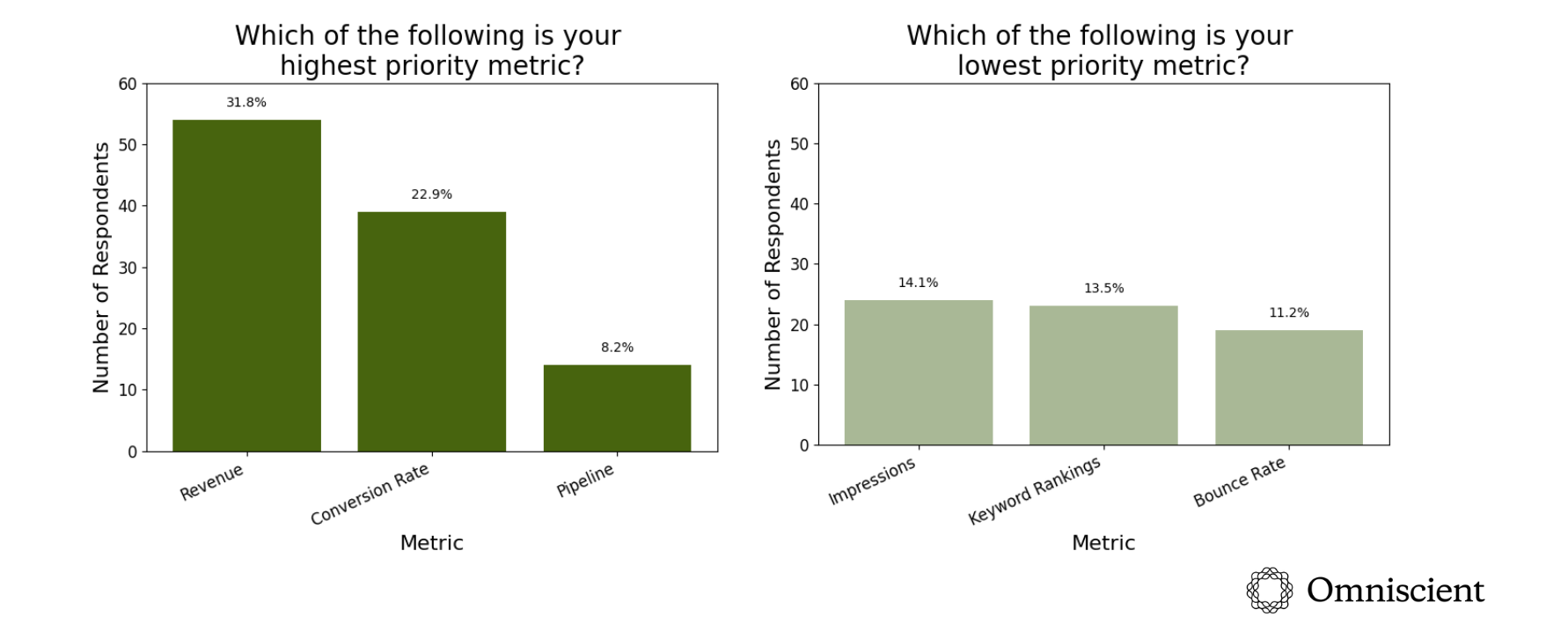

Which metrics actually matter?

People debate whether the numbers they report to leadership should reflect business impact or just make dashboards look impressive.

Across teams we surveyed, the market sentiment is reflected; revenue, conversion rate, and pipeline now top the priority list, while impressions, keyword rankings, and bounce rate rank lowest.

We saw this trend in our Marketing Leaders Report: the north star KPIs that directly show your business is increasing the bottom line are highly regarded, because they show a return on investment.

The point of organic growth is not just to be seen; it’s to win mindshare, earn trust, and convert, putting revenue first and ensuring programs drive pipeline.

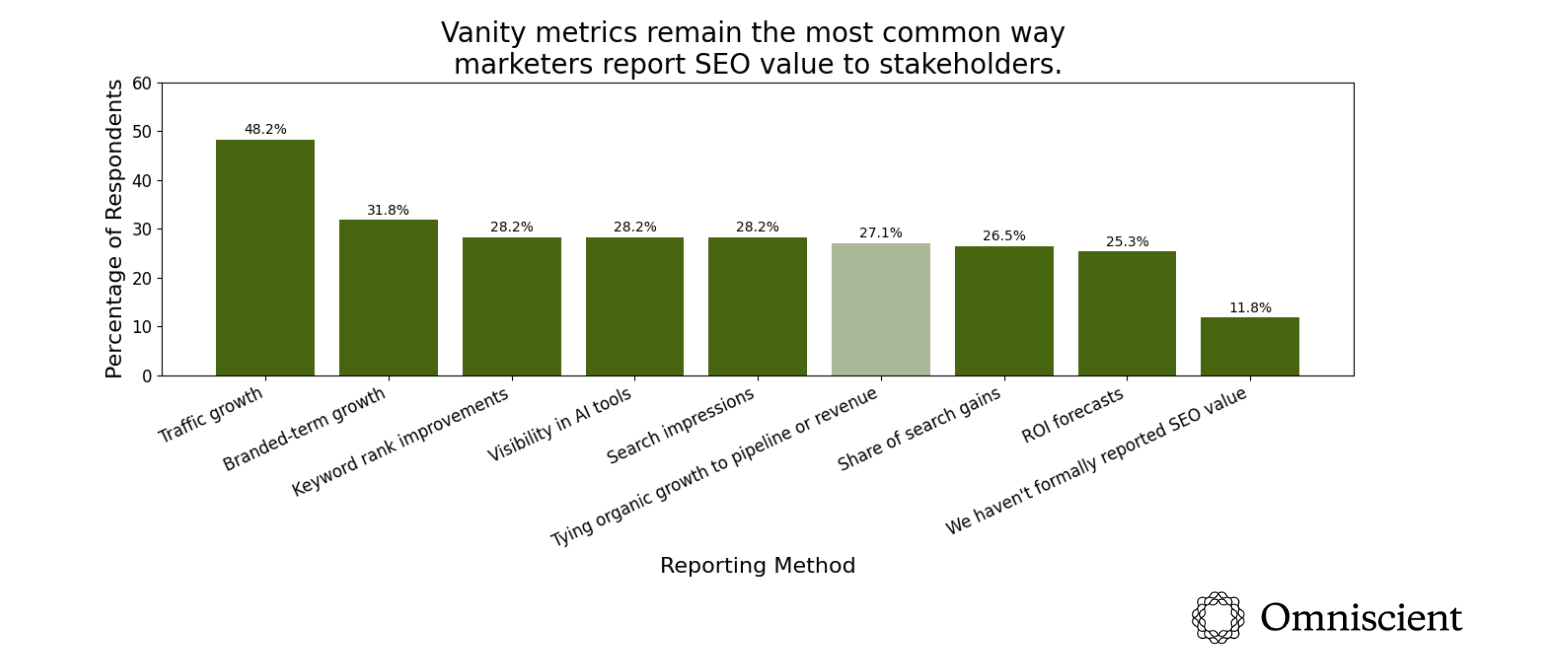

How marketers are reporting organic growth to stakeholders

Only 27.1% of respondents SEO performance to stakeholders in terms of revenue or pipeline.

By contrast, nearly half of all respondents (48.2%) showcase traffic growth to stakeholders, and around one-third highlight branded-term growth or keyword rank improvements – traditional visibility metrics that don’t directly prove business impact.

While metrics like traffic and impressions can signify value, they are often divorced from relevance and targeting, leading teams to enter what we call the “traffic trap” – an endless loop of chasing vanity metrics, which leads to misallocation of resources and efforts and, in many cases, illusory wins.

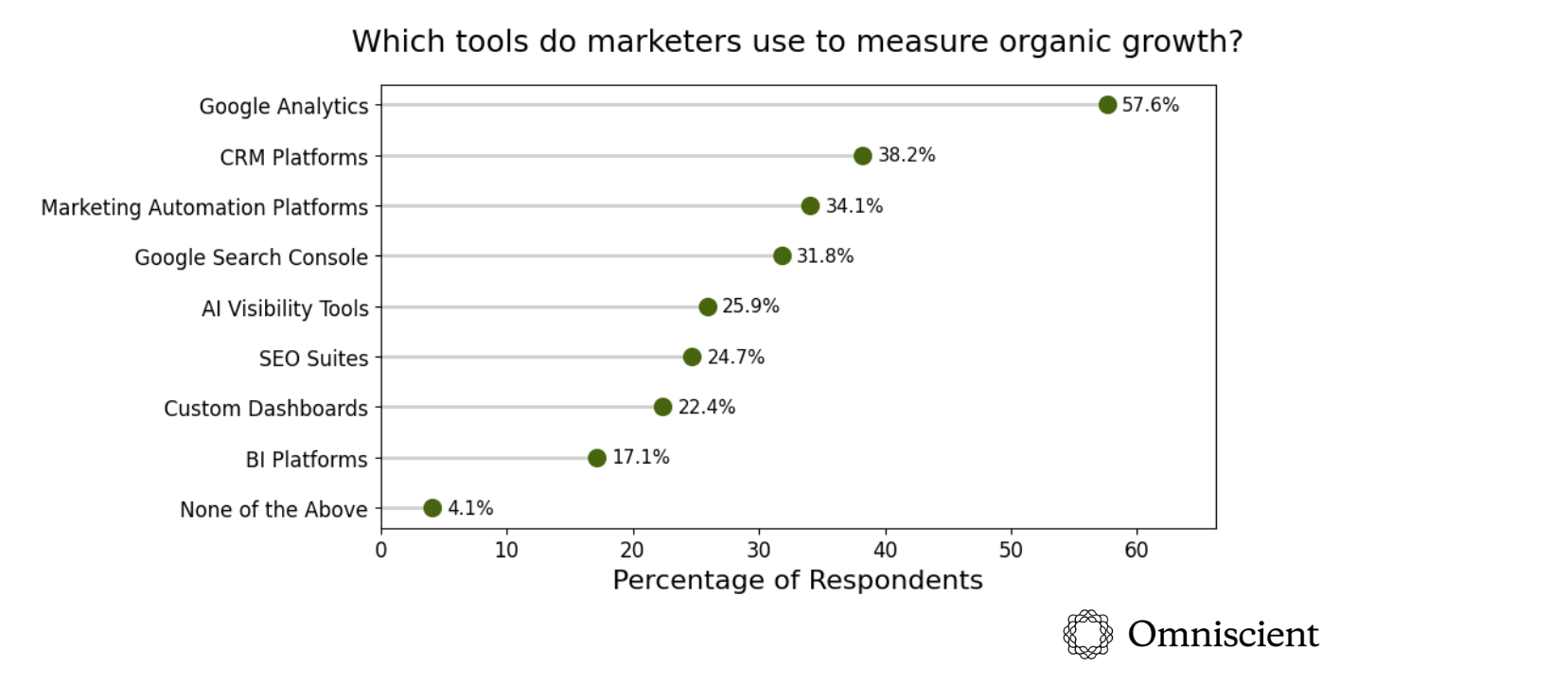

Part of the challenge is academic (which attribution model to choose), and part technical (setting up proper events and goals). But part of the challenge is also the tech stack and what it facilitates.

Teams use tools that track website behavior, not pipeline metrics.

Google Analytics is the most popular organic growth measurement tool, used by 57.6% of respondents.

This makes sense; Google Analytics has long been the dominant web analytics tool.

However, most Google Analytics setups are not built to track downstream behavior like qualified leads, pipeline growth, and revenue. Functionally, this makes it difficult to tie one’s efforts to outcomes beyond a website conversion (and even that, in our experience, is often not set up correctly in GA4).

Out of those using Google Analytics, 40.1% are using GA on its own, meaning they are missing a key component of revenue and conversion tracking.

CRM platforms like Hubspot, Salesforce, and attribution platforms like Dreamdata and Hockeystack are purpose-built to track and attribute revenue metrics. Yet only 38.2% of respondents are using these.

Predicting outcomes with input metrics

The output metrics describe what happened, while input metrics measure what you did to make it happen. These are levers teams can actually pull – publishing cadence, technical audits, outreach activity, and so on.

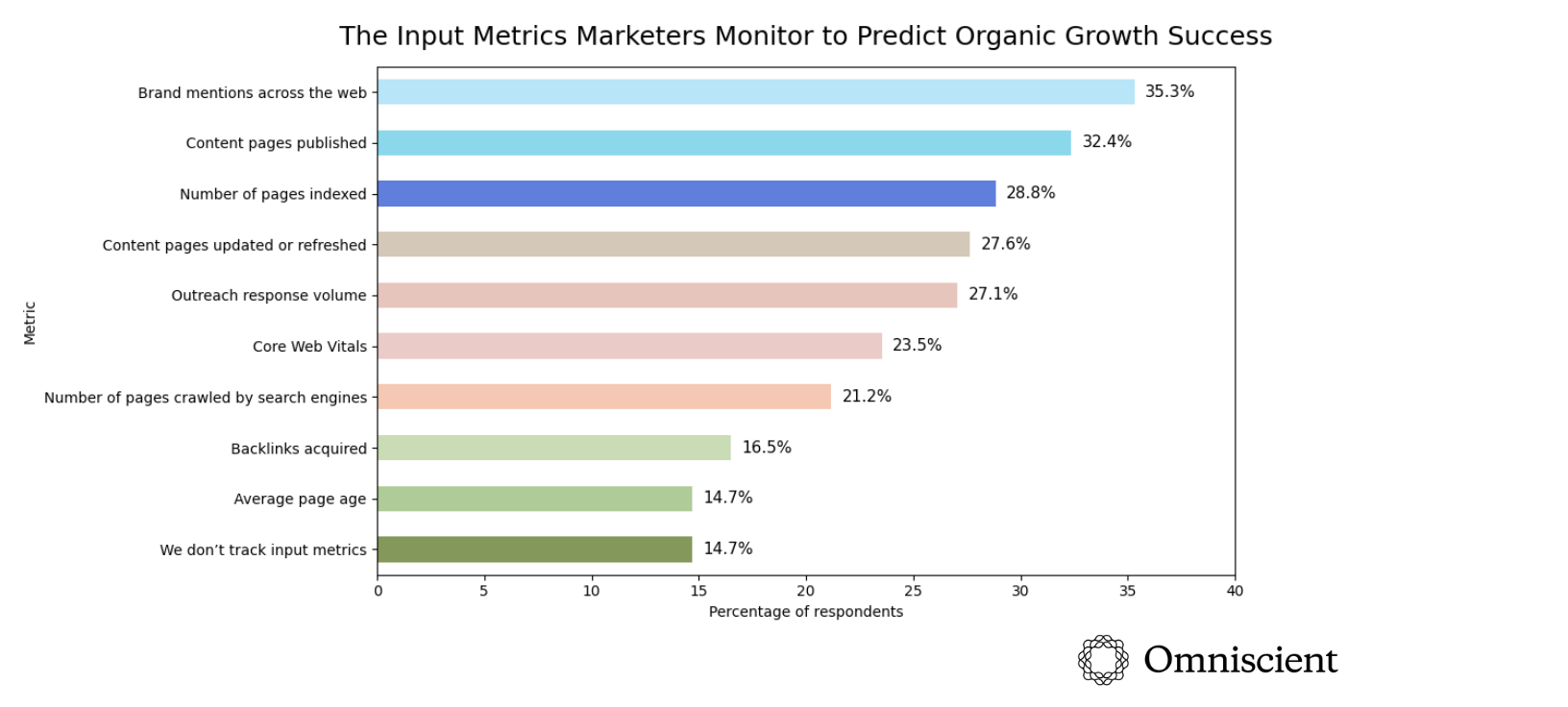

The most common input metrics tracked across groups:

- 35.3% track brand mentions across the web

- 32.4% count their content pages published

- 28.8% look at the number of pages indexed

- 27.6% track how often they update or refresh content pages

- 27.1% measure outreach response volume

85.3% of respondents track input metrics, indicating that most agree these are essential signals of future growth.

The story is not just in how common it is to track input metrics, but how teams that believe input metrics are predictive of outcomes report the highest satisfaction with their organic growth strategy.

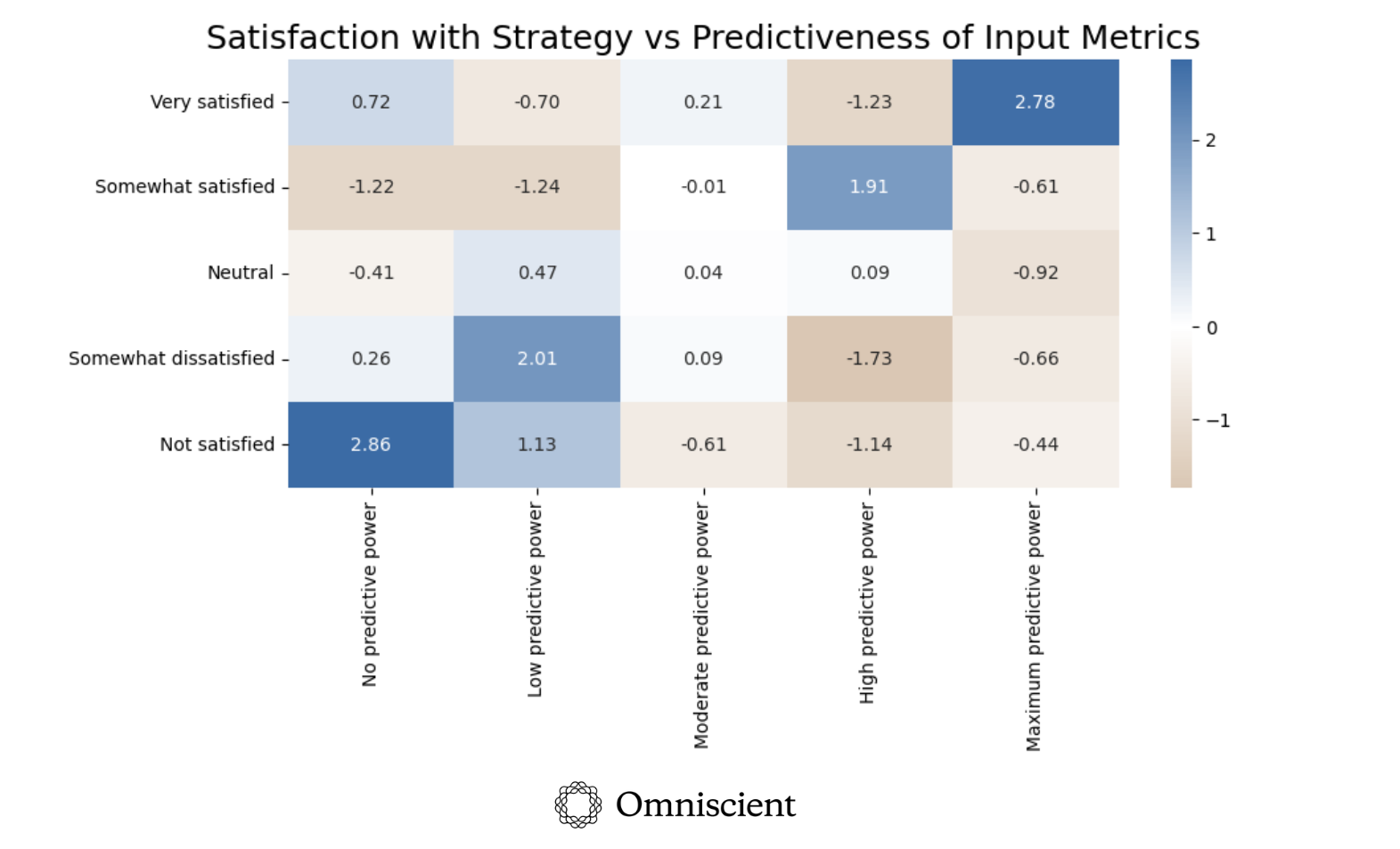

This heatmap shows where satisfaction and predictiveness answers line up more (blue) or less (brown) often than we’d expect by chance. Darker colors mean stronger relationships between the two questions.

However, the relationship is not necessarily one-way. It’s equally plausible that teams already feeling less enthusiastic about their SEO programs engage with them less often, which in turn lowers their reported satisfaction.

In other words, satisfaction and belief in inputs reinforce each other, creating a feedback loop of confidence and action.

Attribution Complexity in the AI Era

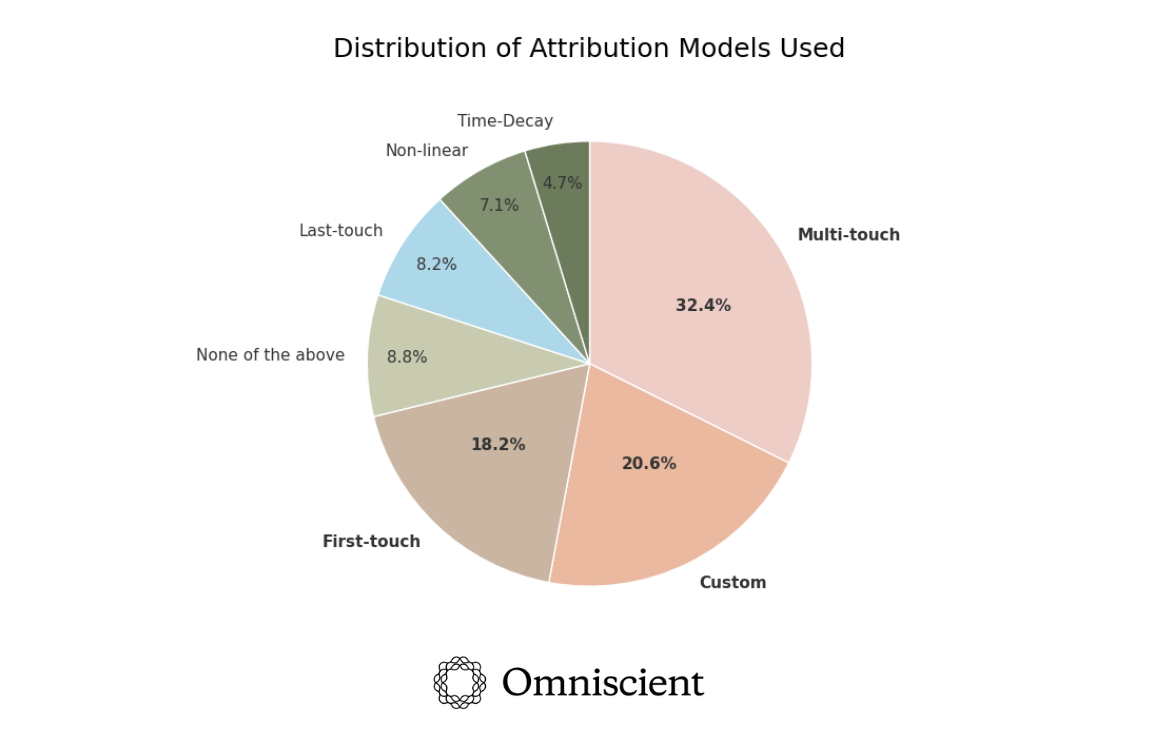

The most popular attribution model is multi-touch.

32.4% of respondents report they use a multi-touch attribution model, followed by 20.6% custom modeling and 18.2% first-touch attribution. 8.8% don’t have an attribution model at all, and only 8.2% of respondents use last-touch attribution.

Multi-touch and custom models are often complex and work under the assumption that they see the entire buyer journey. However, AI introduces more untrackable touchpoints, with zero click answers being the default.

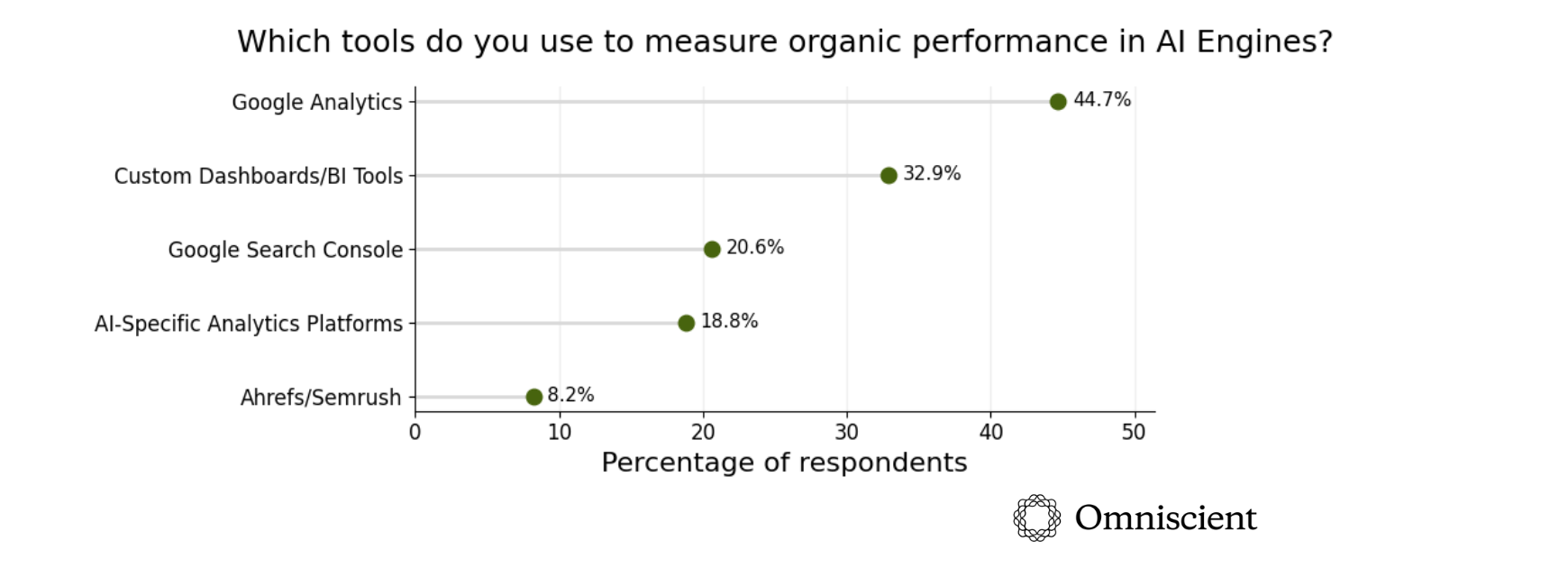

Tools used to measure organic growth in AI

These responses raise a red flag. Google Analytics, used by 44.7% of respondents, can track referral traffic, engagement, and conversions from LLMs, but it is not the best tool for AI attribution.

Only 18.8% use AI-specific analytics platforms like Peec AI or Profound that measure AI visibility beyond clicks.

In order to tie GEO tactics to revenue and pipeline, and report it to stakeholders, marketers need the most accurate analytics they can get.

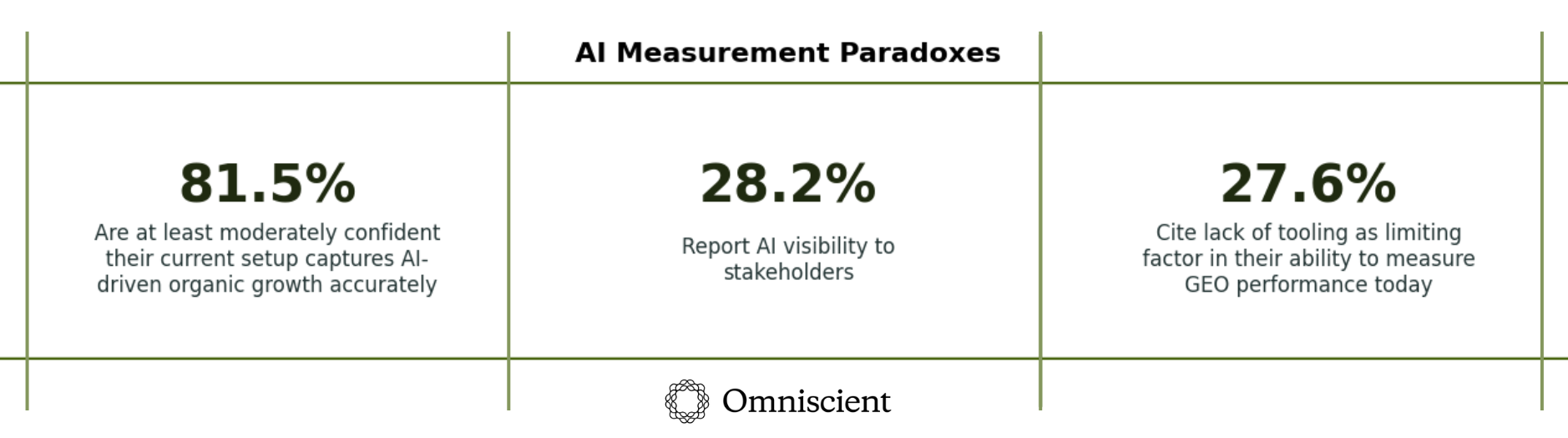

Resulting paradoxes:

- 81.5% feel at least moderately confident in their AI measurement, yet only 28.2% report AI visibility to stakeholders.

- 27.6% cite lack of tooling as a limiting factor to measure generative engine optimization performance.

This presents a gap in marketers’ current analytics approach and what is needed to measure visibility and influence in AI engines.

Marketers trust the numbers from tools that cannot capture the new reality. The result is underreporting AI visibility to stakeholders, misclassifying demand as “direct,” and reinforcing low-intent metrics.

There is a large opportunity here for marketers to level up their organic growth reporting in AI surface areas.

Maturity in AI Attribution for GEO Success

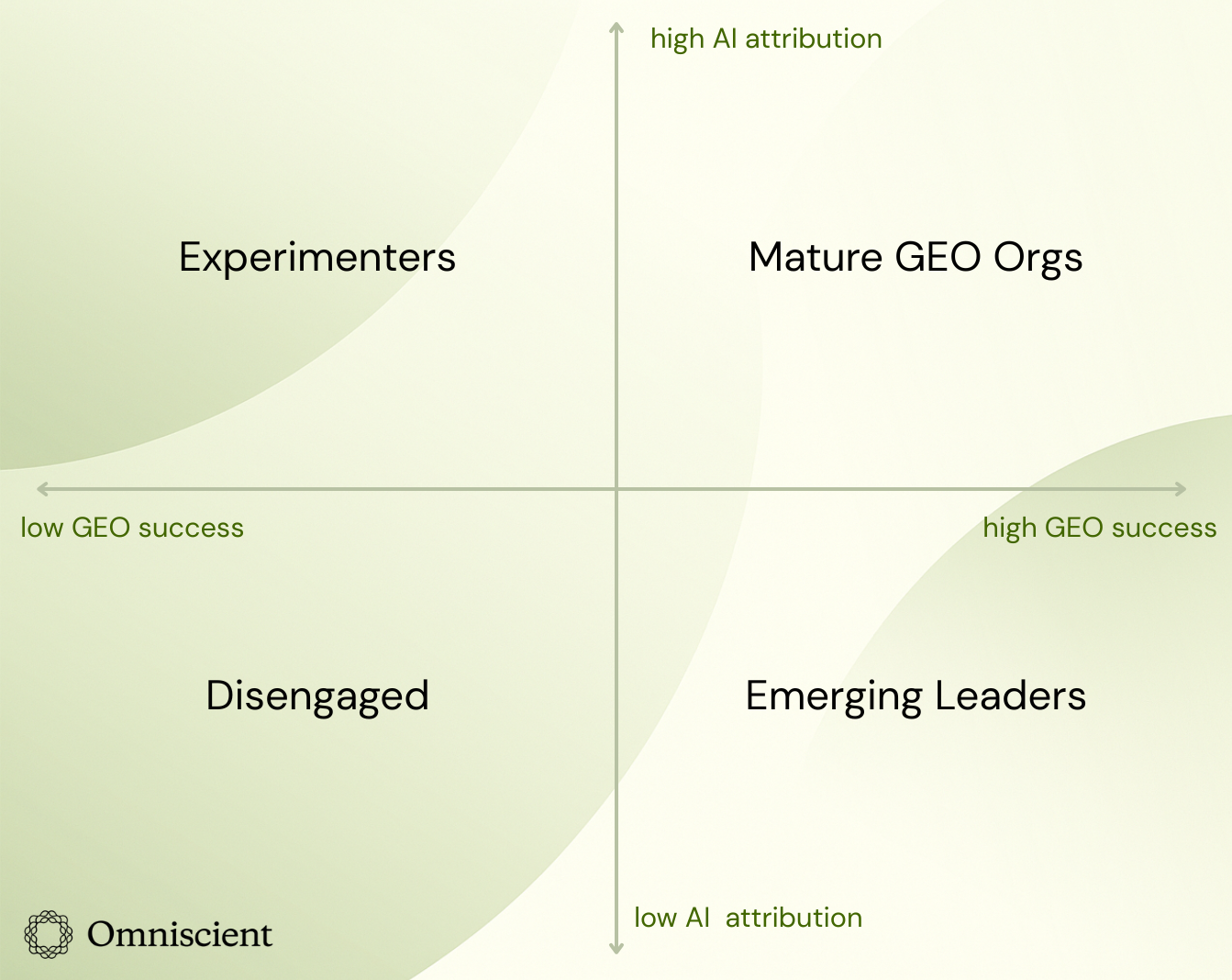

The maturity curve from measurement to mastery

Using aggregated survey data, we identified four distinct clusters based on how teams scored across five measured dimensions of maturity and satisfaction. Each dimension was scored on a 0–4 scale:

- Satisfaction with organic growth performance

- How advanced their AI attribution measurement systems are

- Confidence in AI measurement accuracy

- How central GEO is to overall strategy

- Effectiveness of GEO efforts in driving outcomes.

Patterns across these dimensions revealed four clear clusters – Disengaged, Experimenters, Emerging Leaders, and Mature GEO Orgs – forming a maturity curve from measurement to mastery.

Satisfaction grows with increased AI attribution maturity

In each group, moving from Disengaged to Mature GEO Orgs, the level of satisfaction with team’s overall organic growth strategy increases.

This correlation shows that those who move forward with strong analytical foundations and investment into new methods tend to be more satisfied.

Building stronger measurement maturity remains critical for long-term success, helping organizations turn today’s satisfaction and confidence into repeatable, data-backed growth.

Conclusion

Organic growth has always been shaped by change, and the AI Era is no exception. The data shows that marketers are largely adapting existing practices rather than abandoning them entirely. Traditional SEO metrics remain largely stable among our respondents, with most teams continuing to trust their accuracy and relevance.

The largest gaps appear not in intent but in measurement. Marketers say they value business-level outcomes such as revenue, pipeline, and conversions, yet their executive reporting often indexes on visibility metrics like traffic and keyword rankings. Only 31.8% tie organic growth to pipeline or revenue in stakeholder reporting.

AI visibility presents another gap. Fewer than one in three marketers report AI visibility to stakeholders, and fewer than one in five use AI-specific visibility tools. While teams recognize the importance of understanding the full buyer journey, many lack the systems or integrations to measure it effectively.

Satisfaction correlates most strongly with measurable control. Teams that believe input metrics are predictive of outcomes, invest in AI attribution maturity, and maintain focus on GEO report higher satisfaction with their organic growth performance. These findings suggest that confidence and clarity grow where measurement systems evolve alongside strategy.