In our fast-moving digital world, search engine optimization (SEO) for financial technology (FinTech) comes with its own unique challenges. Financial brands must compete with strict regulation and complex jargon—while also trying to stay ahead of technological changes.

In this guide, we will explore why many FinTech brands struggle with rankings and organic traffic. We’ll also look into how to overcome these with innovative SEO strategies.

These aren’t black- or grey-hat hacks that search engine algorithms like Google and ethics regulations frown upon. These strategies combine human psychology and authentic SEO practices, so they’re here to stay.

Whether you’re a start-up FinTech or an established institution, this article offers practical steps to grow your online presence. Use it to bring in more quality website traffic and customers in 2025.

Understanding the FinTech landscape

Fixing the SEO-Finance paradox means looking at how to apply SEO strategies and new technologies in the FinTech space. The first step is to understand why this space is different.

Definition and scope of FinTech

FinTech companies use digital technology to automate financial services. This covers a wide range of solutions, such as financial app development services that include mobile payment apps and online lending platforms to blockchain technology, robo-advisors, and even decentralized exchange development.

The core idea of FinTech is to simplify financial processes for businesses and customers. Offering new ways to manage banking operations and investments makes the process easier and faster for everyone involved, including FinTech brands.

A typical example of early FinTech development is Revolut. This company built a user-friendly app that lets people track their spending, save money, or invest with just a few taps, and it highlights how a skilled fintech app developer can simplify complex financial workflows into a seamless mobile experience. Revolut removed the man-in-the-middle approach of traditional banking. Customers no longer need to call customer service or find their physical banking key whenever they want to manage their cards. They can now do it from the app.

Soon, many businesses and personal customers realized that traditional banking was the past and FinTech was the new banking world. It’s faster and a lot more convenient.

Key trends shaping the industry

As FinTech becomes the new norm for banking customers, integrating AI in FinTech accelerates innovation across the industry.

Here are some trends that FinTech companies are jumping on:

- Mobile banking: Nearly everyone uses smartphones, which means more consumers expect banking services on the go. They want to pay, manage their cards, and transfer money without an ATM or heading into a branch. FinTech companies offer a seamless mobile experience with Open Banking and Open payments. You can also get high-risk merchant services for industries that are not accepted by traditional merchants like Stripe or Square.

- Blockchain and cryptocurrency: Bitcoin launched the growth of digital currency and the blockchain. This is becoming a vital part of any FinTech ecosystem, especially as the bitcoin price continues to influence market trends and investor sentiment. It offers secure, fast, and transparent transactions. Obtaining a VARA license is essential for companies operating in regulated markets to ensure compliance and build trust with users and investors.

- Regulatory technology (RegTech): Security and compliance are vital in the financial world. Going digital and implementing new technologies like blockchain means tightening regulations. That’s why many FinTech companies also use technology to meet compliance requirements.

- Personalized financial services: Data analytics, machine learning, and AI in banking offer near-instant reporting that was once impossible. Nowadays, FinTech companies are creating models that can draft personalized financial solutions.

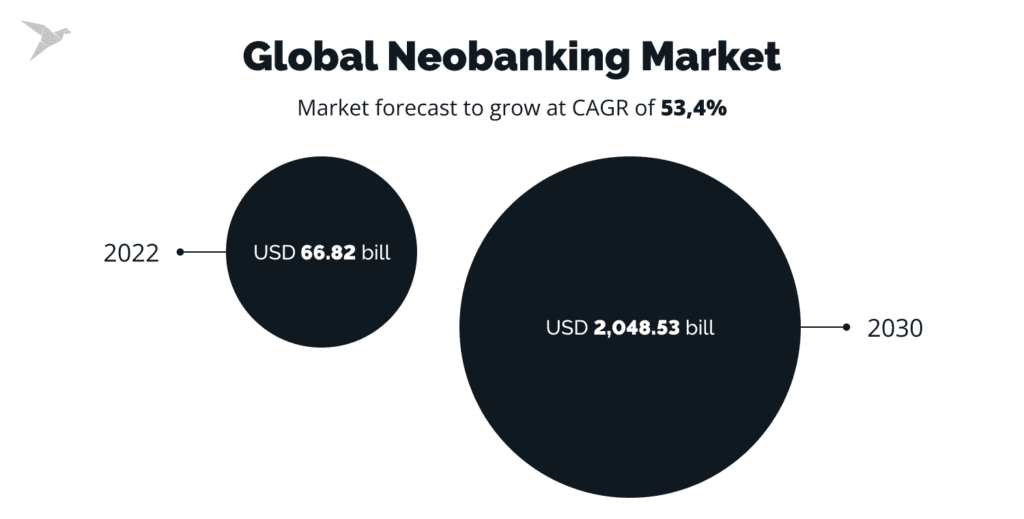

- Neobanking: Neobanking refers to brands that don’t offer a full banking experience. Instead, they focus on select services like investments. This reduces their expenses and allows them to focus on providing higher-quality services.

- Increased competition: Traditional banks are now racing to adopt FinTech innovations. This is leading to a more crowded marketplace.

Here’s the growth forecast for the global Neobanking market:

Keyword research and optimization

In FinTech, getting results from your SEO strategy means more than just finding high-value keywords. Competition is tough, so you’ll want to look for ways you can grow steadily but also quickly.

Identifying high-intent keywords specific to FinTech

Users who search for FinTech solutions know what they’re looking for. They’ve heard about FinTech and want a solution that meets their needs.

So, look for high-intent keywords that signal they’re ready to take action.

For example, they might search for things like:

- “Virtual cards”

- “Best apps for personal finance”

- “Competitor alternatives”

Start by brainstorming terms and secondary keywords related to your product or service. Look at competitor sites, tools like Ahrefs, and even the help of AI to get ideas. Then, filter using keyword research tools to uncover related phrases your target audience might use. These tools will also help you find which keywords to prioritize or leverage from your competitors.

Utilizing long-tail keywords to target niche audiences

Long-tail keywords are longer, specific queries that indicate a higher intent. This means higher conversion rates, albeit lower search volumes.

For example, “how to choose the best mobile banking app” is a long-tail keyword. It indicates that the reader is ready to choose a solution. This makes them highly qualified, bringing a much higher conversion rate on average than someone searching for “fintech banking.”

Long-tail keywords are less competitive and easier to rank for. They can also help you target smaller niches. This is an excellent advantage if you have sub-audiences for your services.

To use long-tail keywords, consider including them in your body text, headlines, and meta description. Make sure there’s a natural flow so they sound like a built-in part of the article instead of an afterthought.

Tools and techniques for effective keyword research

Several tools can help you pinpoint the best FinTech keywords for your content:

- Google Keyword Planner: This free keyword tool by Google provides insight into search volumes and competition.

- Ahrefs, SEMrush, and Ubersuggest: These are paid tools with a free version that provide in-depth keyword analysis, backlink data, and competitive intelligence.

- AnswerThePublic: This tool helps you uncover common questions and phrases that people type into search engines.

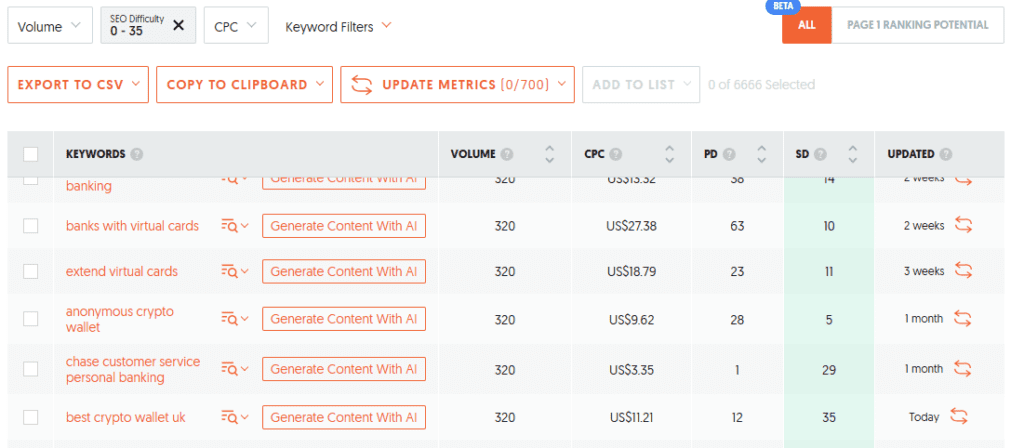

Here’s one of the dashboards from Ubersuggest’s keyword ideas tool:

Screenshot provided by the author

On-page SEO strategies

On-page SEO is about making your website content as attractive as possible for search engines and readers. The goal is to capture your target audience’s search intent and appear in their top search engine results.

Following the best practices of technical SEO improves your rankings and provides a better user experience.

Crafting compelling meta titles and descriptions

Meta titles and descriptions are like your company’s opening lines in the search engine world because they make the first impression.

Search engines use them to show snippets of your content in search results. They also provide a summary of your pages.

A strong meta title should include your target keyword and be clear about the page’s content. Meta descriptions should be enticing, with a brief summary and a call to action. The goal is to get the right audience to open your page.

Keep your titles short, under 60 characters, and your meta descriptions under 160 characters. This ensures they display properly in organic search results, especially on mobile. Keeping these concise attracts clicks and improves your overall SEO performance.

Here’s more information on technical SEO if you’re interested.

Optimizing content for readability and engagement

Complexity and legal-like wording require more energy and focus to understand. This makes it very hard for visitors to continue reading and flow from one section to the next. As a result, it’s much easier for them to bounce and for companies to lose a customer.

Instead, your content should be easy to read and understand. Here are some tips:

- Use simple language and shorter sentences.

- Aim for a readability grade of 7-8.

- Break up text with headers, lists, and visuals to keep engaging your readers.

- Write in an active voice and direct style.

- Avoid jargon and complicated legal wording.

Consider adapting your brand voice. While FinTech is more serious than other niches, your customers are still human. Most people talk in a conversational voice, and matching them can set you further apart from traditional banking while remaining professional.

Check this article for six more tweaks to make your FinTech website more visible.

Importance of mobile-first design and site speed

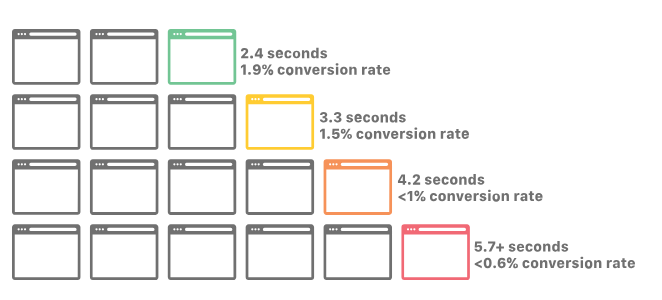

A fast and secure website often depends on the quality of your hosting provider. In fact, there’s a direct relationship between site speed and conversions, especially when managing cloud infrastructure or implementing financial operations tools, which is why many organizations opt for custom fintech websites optimized for secure, high-speed performance.

Here’s an aggregated speed report by Cloudflare:

Many financial brands rely on WordPress for their websites, but poor hosting choices often undermine their SEO efforts. Additonally, some WordPress disadvantages can create hidden obstacles that impact site performance and security. Slow load times, frequent downtime, and security vulnerabilities frustrate users and hurt search engine rankings. Security vulnerabilities can be effectively identified and addressed with the help of a black box scanner, which uncovers hidden issues and provides crucial insights to enhance both the site’s security and its SEO performance.

Managed WordPress hosting addresses these challenges by providing high-performance servers, automated updates, and robust security measures. With a reliable hosting provider, financial brands can boost site speed, enhance security, and maintain compliance—which are key factors in overcoming SEO obstacles and achieving higher search visibility.

Building authority and trust for SEO for FinTech

In financial services, trust is everything. Your content must show expertise, authority, and trustworthiness to rank well. Many refer to this as E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness).

Importance of E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness) in financial content

Google constantly adds new technologies to protect its users from fraud and online scammers. That’s why it places a high value on content that demonstrates E-E-A-T. In SEO for FinTech strategies, this means:

- Experience: Showing real-world knowledge and case studies.

- Expertise: Providing detailed, accurate, and up-to-date information.

- Authoritativeness: Citing credible sources and having recognized experts who contribute or mention you.

- Trustworthiness: Ensuring that your site is secure and your information is reliable.

Focusing on E-E-A-T means improving your FinTech SEO ranking and building trust with your audience. This is a must for any online business with online visibility.

Strategies for acquiring high-quality backlinks

Backlinks from reputable websites signal to search engines that your content is trustworthy. This helps increase the strength of FinTech SEO, leading to higher rankings over time.

Here are link-building strategies you can adopt as part of your content marketing:

- Guest posting: Write quality articles for other reputable sites. Choose sites in your niche or with readers that match your target audience.

- Partnerships: Look out for industry influencers you can collaborate with. These could be people or other businesses in the same niche that serve other audiences.

- Press releases: Share newsworthy developments that attract media coverage.

- Content outreach: Share your in-depth guides and research studies with journalists and bloggers.

It takes time to build a large number of backlinks, but it pays off in visible authority and higher rankings.

Leveraging customer testimonials and case studies

You can build social proof and credibility by using case studies and customer testimonials. Potential clients who see real examples of success are more likely to trust you.

For instance, include quotes from satisfied clients or publish detailed case studies. Try to build social proof for every service and niche audience you serve.

This approach adds to your content marketing strategy, builds trust, and resonates with a highly educated audience. People who spend time researching case studies are typically highly aware and more likely to buy now.

Make sure to publish these testimonials on your website. You can also share them on social media and use them in your paid ad campaigns.

For more examples of how case studies and testimonials work well as part of SEO for FinTech strategies, check out this article on SaaS SEO.

Information gain opportunity: Leveraging emerging technologies

Technology is changing fast. FinTech companies must adapt to new digital trends to stay ahead. AI and voice search are two emerging technologies that hold great promise in FinTech SEO.

Utilizing AI and machine learning for SEO insights

AI and machine learning (ML) algorithms are transforming many areas of digital marketing, including SEO. These tools can quickly analyze large data sets to reveal trends and patterns that are hard to see manually.

You can use AI and ML to:

- Analyze competitor data: Quickly compare your site with competitors.

- Predict trends: Forecast which specific keywords will become more popular.

- Personalize content: Adapt your content for better engagement. One way to do this is to create content for each niche audience and use the keywords that they search.

For example, some tools use AI to analyze search data and suggest improvements for your meta tags, headings, and content structure. They can also generate metrics to help you improve and build high-quality content. This means you can adjust your strategies in real time and stay ahead of your competitors.

Voice search optimization in the FinTech sector

Voice search is becoming increasingly popular. A Statista survey shows that in 2022, 52% of Americans used voice search to order food delivery. Another survey found that the number of voice assistant users is expected to surpass the 157 million mark in 2026.

Optimizing for voice search means knowing how your potential customers speak and ask questions.

Here’s how you can do this in your FinTech business:

- Using natural language: Write content that answers questions like you are speaking to a friend.

- FAQs: Create clear question-and-answer sections that are easy for voice assistants to parse.

- Local SEO: If your business has a physical location, ensure your address, hours, and contact info are up to date.

By building content for voice search, FinTech companies can target a growing segment of users who prefer spoken queries over typed searches.

For more insights on content strategies and digital marketing trends, look at this article on AI topic generation.

Conclusion

The FinTech industry is growing, and it’s becoming more challenging to compete. Blending SEO strategies with emerging technology can help FinTech companies stand out.

Financial brands can rank higher by understanding the industry, targeting the right keywords, and boosting authority. This boosts their online presence, makes them more competitive, and increases their organic conversion rates.

If you are looking for more guidance on FinTech marketing, such as a content strategy, consider this article on the top enterprise SEO agencies. Be sure to look out for how and why brands like Adobe, SAP, and Jasper chose to work with us at Omniscient Digital.

And, if you need personalized advice for your FinTech SEO strategy, contact us today to help you scale and stand out.

Author bio:

Kelly Moser is the co-founder and editor at Home & Jet, a digital magazine for the modern era. She’s also the content manager at Login Lockdown, covering the latest trends in tech, business, and security. Kelly is an expert in freelance writing and content marketing for SaaS, Fintech, and ecommerce startups.