Have you heard of Pithole City?

It’s known as the oil boomtown that vanished nearly quickly as it appeared.

What happened is fairly straightforward: someone struck oil, which was widely reported in the nation’s newspapers in January 1865. Houses, hotels, and businesses were quickly built in the town (previously a humble cornfield).

More wells were struck, and drillers, speculators, gamblers, and business owners flocked to the opportunity, with 15,000 people living in the area by that fall.

In anticipation of fortune and scale, innovation flourished. In October 1865, Samuel Van Syckel completed what many historians regard as the first successful U.S. oil pipeline: roughly five miles of two-inch pipe, driven by steam pumps, that moved crude from Pithole to the Oil Creek railhead, cutting transport costs. It was described as a “revolutionary means of transporting oil.”

But boom turned to bust. By mid-1866, production waned, fresh strikes nearby diverted capital and labor, and a series of fires accelerated the exodus.

Businesses folded, hotels shuttered, and property values collapsed; within a few years Pithole was functionally abandoned, and in 1877 the borough was dissolved.

Today, the site is preserved by the Pennsylvania Historical & Museum Commission with a visitor center – a reminder of the speed with which hype metastasized into infrastructure and then ash.

Pithole City today (source)

Now, your author is very interested in history and the industrial revolution. He’s also clearly very pleased that he was able to take a small story from the book he is reading, Titan, and to employ it as a cautionary tale to those wondering how to invest in organic growth.

If you read the rest of the book, it’s apparent that oil, generally, was a transformative trend that turned John D. Rockefeller into the richest man in the world. It also resulted in astonishing and useful technological innovation (e.g. Van Syckels’ pipeline)

However, many people who flocked to Pithole City (and the many other boom and bust examples – gold, oil, tulips, crypto, whatever) went broke, unable to recover. They lost their shirts, so to speak.

It may not be prudent to put all of one’s chips into a single speculative venture, especially if one has no way to recover from total loss.

“What Are We Doing About Reddit?!”

There’s a particular kind of dizziness that comes from staring too closely at the wrong kind of data.

I call it marketing whiplash.

It happens when you check the dashboard too often, when you confuse volatility for insight, when you mistake the noise of the moment for the long arc of signal.

It’s an affliction that seems especially common in the age of AI search.

One week, Reddit appears to be the golden goose. The next, Wikipedia. Then YouTube.

Studies emerge breathlessly declaring the primacy of these platforms in the citation patterns of language models, and suddenly you see otherwise sensible leaders lurching toward “Reddit strategy decks,” as if posting in a thread were the next great frontier of brand building.

But this is (aggregate) data (that is often misinterpreted) masquerading as strategy.

To take it at face value is to miss the point.

Wikipedia is cited because it is enormous and spans into millions of topics, offering definitional and comprehensive pages on those topics, not because it holds the keys to your growth.

Reddit brims with brand mentions, yes, but most of them are downstream of product quality, customer experience, and word of mouth — not the consequence of a marketer cleverly dropping links into a thread.

Gaetano DiNardi wrote a wonderful essay on this: “Posting on Reddit isn’t an SEO strategy—it’s shouting through a bus window, hoping to join the conversation. At best, it’s a short-term hack; at worst, it wastes time and risks backlash.”

The More You Look, the Less You See

Look, I’m a data-driven guy. I ran experimentation teams and have rebuilt more analytics setups than I can count.

But we have to come to realize that sometimes the medicine can also be the poison.

One of my favorite Nassim Taleb quotes speaks to this:

“The more frequently you look at data, the more noise you are disproportionally likely to get (rather than the valuable part, called the signal); hence the higher the noise-to-signal ratio. and there is a confusion which is not psychological at all, but inherent in the data itself. Say you look at information on a yearly basis, for stock prices, or the fertilizer sale of your father-in-law’s factory, or inflation numbers in Vladivostok. Assume further that for what you are observing, at a yearly frequency, the ratio of signal to noise is about one to one (half noise, half signal) – this means that about half the changes are real improvements or degradations, the other half come from randomness. This ratio is what you get from yearly observations. But if you look at the very same data on a daily basis, the composition would change to 95% noise, 5% signal. And if you observe data on an hourly basis, as people immersed in the news and market price variations do, the split becomes 99.5% noise to .5% signal.”

For instance, I recently saw a LinkedIn post claiming that Reddit has all but disappeared as a citation source in ChatGPT. I don’t know if it’s true. I spent less than three minutes thinking about it, because it will not affect my work or my team’s work. If it is true, I don’t know if the trend has sustained itself or if Reddit has reclaimed its throne.

In times of uncertainty, we latch onto narratives, patterns, and signals (even if they are illusory). This is natural, as many marketers are pressured to have answers when asked “what is our AEO playbook?”

But what happens – especially in noisy social media environments that do not and will not ever encourage nuanced capital T Truth – is that we look too frequently, too closely, and we bite on patterns that are merely random – or perhaps not random, but are simply not useful to us, specifically.

We are redirected through these patterns, investing in new initiatives that may or may not pay off, which results in opportunity costs. Every decision, by definition, comes with an opportunity cost.

The roots of the word “decide” are the Latin prefix de- (“off,” “away”) and the Latin verb caedere (“to cut,” “to strike,” “to fell”). The word’s original literal meaning was “to cut off,” which evolved to signify the act of cutting away or eliminating other options to settle on one.

Choosing Reddit to invest somewhere is also choosing not to invest elsewhere

If you decide that Reddit is the shiny new object and pour resources into manufacturing conversations there, what are you cutting away?

Agility Without Thrashing

I’ve spoken with friends at Profound, Search Party, and elsewhere about the volatility in this new ecosystem.

They describe a landscape where the rules shift monthly, sometimes weekly. One moment, being indexed on Bing meant you were discoverable in ChatGPT. Then ChatGPT decoupled from Bing, and the model’s data sources became opaque again. In our podcast conversation, Nick Lafferty compared the release of GPT-5 to a Google algorithm update — sudden, sweeping, and destabilizing for those caught unprepared.

Josh Blyskal put it even more directly: “Agility is a moat in this channel.” The companies who can accept change, pivot quickly, and embrace the uncertainty — without succumbing to whiplash — are the ones who will endure.

The distinction matters. Agility is not the same as thrashing.

Thrashing is chasing every new spike in a chart, every whisper of a new tactic, every blog post about citation patterns. Agility is steadiness with flex: the ability to absorb volatility without being consumed by it.

Thrashing, as a jiu jitsu practitioner, is what white belts do. It’s a chaotic waste of energy that allows a more mature practitioner to wait for the right moment and submit them easily.

I do think that agility, and even a sense of openness and alacrity in trying new things and experimenting, is a powerful trait.

But it must be coupled with disciplined focus, as Frank Slootman noted in his famous essay, Amp It Up:

“Quickening the pace also drives a narrower focus. You simply can’t move very fast when you are pushing on too many fronts at the same time..”

The Portfolio, the Moat, and the Moonshot

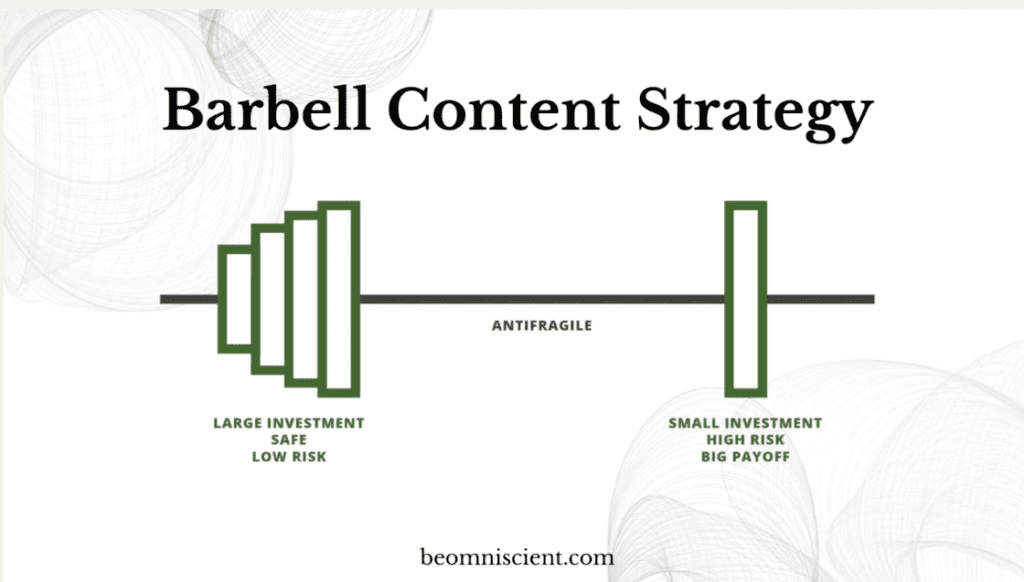

The way through is portfolio thinking.

Not all bets are equal, and not all are worth placing. A wise strategy balances them. Some are risky, asymmetric gambles — they may fail nine times out of ten, but the tenth outcome is transformative.

Others are steady, compounding moves that may not look exciting in the moment but build the fortress walls of your brand: your owned content, your customer research, your quiet ubiquity in the sources that matter for your niche.

Tim Ferriss once said he chooses projects that are worth doing even if they fail. His podcast, in its earliest days, was justified not by the prospect of millions of listeners, but by the relationships, skills, and enjoyment it brought.

Even a “failure” by external metrics was a personal success. That’s the kind of investment you want in your portfolio: the win that remains a win even if it loses.

A heuristic I often ask myself in figuring out AI search is, “if AI were not a thing, would this still be a valuable tactic?”

If the answer is yes, we can assume that it falls into the “win even if we lose” category. Creating website content that answers your prospects questions is unlikely ever to be a net negative action.

If the answer is “no,” it still may warrant experimentation. This is why we allocate some percentage of investments to high upside but low certainty bets (the equivalent of investing in early stage startups versus bonds).

This has, by the way, forever been our operating model. We borrowed the Barbell Strategy and applied it to SEO and organic marketing:

The same logic applies here.

Crafting content that speaks to your customers’ nascent questions is never wasted. Even if a new AI model tomorrow stops citing YouTube, the act of creating thoughtful video content builds skills, artifacts, and a presence that pays dividends in other ways.

Contrast that with a short-term hack, such that you may hear on the seedy corners of X or LinkedIn: spinning up thousands of highly specific pages based on personas and FAQs. Or the return of PBNs, but this time as a way to seed brand mentions. If the tactic fails — and it likely will, in time, if you play out just a little bit of game theory — what remains? Little more than a pile of deleted posts and perhaps a dented reputation.

We live in an era of heightened volatility. AI search will not stabilize tomorrow; it may not stabilize for years. The temptation is to match volatility with volatility, to flail at the noise in hopes of extracting a signal. But the wiser path is patience, discernment, and the discipline of portfolio allocation.

Cut away the false options. Invest in the bets that compound. Choose a few risky swings that are worth swinging. And above all, resist the whiplash (especially when it comes from LinkedIn thought leaders whose incentive is to drive FOMO into the hearts of busy marketing leaders).

Long Game Thinking

Oil, and the industrial revolution as a whole, made a lot of people a lot of money. But putting all your chips in a speculative investment is, has been, and always will be a wonderful way to lose it all.

I’m not a man who ventures out with too many predictions (for reasons I’ve written about ad nauseum), but we can clearly see this trend playing out, including long before generative AI went mainstream (featured snippets, delphic costs, etc.).

So, we can take a long view and build a portfolio of bets that very likely sets us up for success in that world. In other essays, I’ve talked about these principles, like brand gravity and Surround Sound SEO, a hyper focus on your ICP and customer research, differentiation and quality moats.

In the short term, we can remain agile and experiment, which is also very, very fun. But we need not risk our futures on speculative predictions or rapidly shifting data.

I lean on him too much, but here’s another Nassim Taleb quote to round it all out:

“An interesting apparent paradox is that, according to these principles, longer-term predictions are more reliable than short-term ones, given that one can be quite certain that what is Black Swan-prone will be eventually swallowed by history since time augments the probability of such an event.”

Want more insights like this? Subscribe to Field Notes