A friend in NYC came to me a few months back. Smart founder. Early traction. Little SEO experience.

“We’ve got a solid app and lots of active users, but now a bunch of knockoffs are showing up and outranking us. What are we doing wrong?”

This, of course, is a common and classic entry point into SEO (competitive FOMO)

I took a peek under the hood.

It was immediately clear there were some use cases, competitor comparisons, categorical and pain point blog posts they could target.

A quick temperature check in Ahrefs showed that there would be a pretty solid search volume and opportunity with merely a dozen or so pages published, representing a potential of some 10,000+ monthly searches.

They were impressed, and they got to work implementing some of the obvious opportunities.

Curious and smart founder he is, my friend asked me how I came up with these opportunities:

“Can you walk me through how you spot search topics that our competitors aren’t covering—or ones where it would be easy for us to rank near the top? What first step do you recommend to identifying the right keywords for this vertical?”

In other words, he was asking me how I do keyword research.

Which is a deceivingly difficult thing to explain, mostly because, beyond the basic stuff like content gap analysis, it’s an idiosyncratic process with a whole lot of back-of-the-hand pattern recognition and personal flair.

An easy answer would be to say, “pop your website into Ahrefs, compare it to 5 competitors, and see which terms they rank for that you don’t.”

But that’s only one angle, one that is overrepresented in SEO, and that has very little alpha. This approach would also likely leave them chasing irrelevant, high-traffic terms at the expensive of niche topics that would drive business.

I love a good question, though, and used it to distill my thoughts on keyword research and think about how I could communicate this simply to non-SEOs.

The way I explained it was that there are four high level phases of keyword research: collection, filtering, prioritization, and planning.

In the collection phase, you’re looking to scan the landscape of possible and relevant opportunities, and in that collection process, there are two high level approaches:

- Top down

- Bottom up

Top-Down: The Known World

Let’s start with the familiar.

There are two methods I’d bucket under the top-down umbrella. Both are great starting points.

1. Content Gap Analysis

This is the most common method in SEO playbooks.

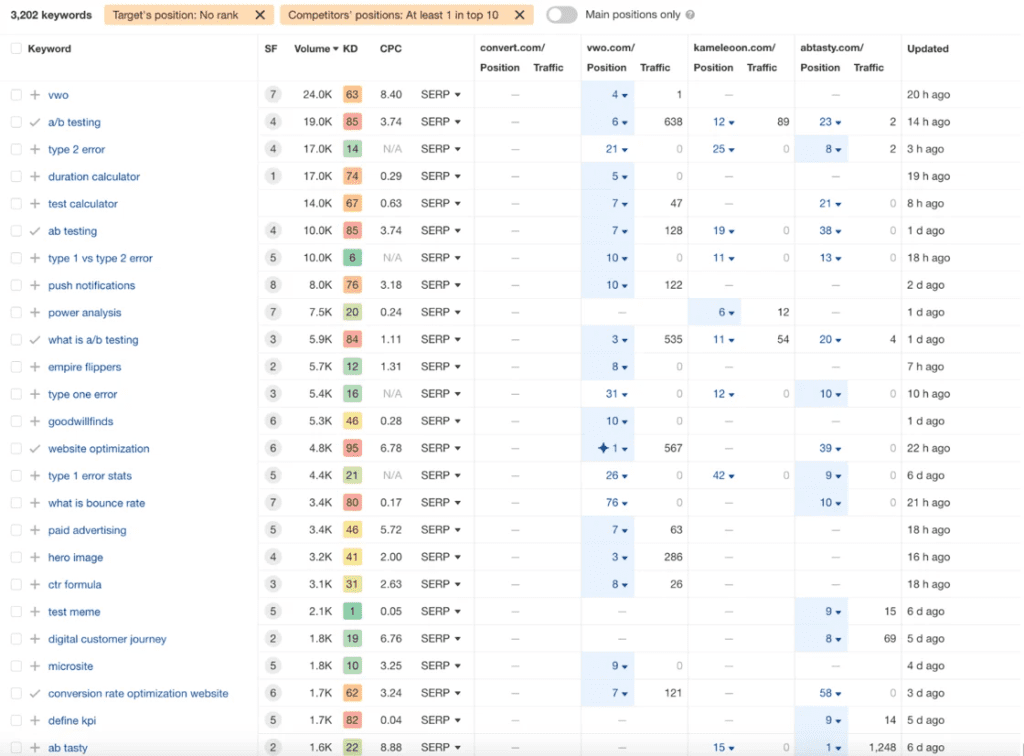

You plug in your domain and those of your competitors into Ahrefs or Semrush. Run a content gap report. Sort by MSV. Export the keywords they rank for that you don’t, and then filter out branded and non-relevant terms.

This one, for convert.com, took me about 16 seconds:

It’s a fantastic starting point, and especially if you know which competitors to include (which, is to say, not the first 1-2 biggest ones that come to mind, but smaller and scrappier teams and indirect organic competitors), you’re almost certain to find a ton of interesting opportunities.

Gap analysis is useful if you treat it like reconnaissance:

- It shows you where you’re absent from known conversations.

- It helps you calibrate against category expectations.

- It is likely to uncover high expected value opportunities to unseat competitors in zero sum SERPs.

But this method, in isolation, abstracts out performance and intent, and is centered on historical data (and overrepresents, typically, high volume TOFU phrases with high difficulty).

Starting point, not finish line – otherwise your organic strategy is aggregated mimicry.

2. Land and Expand

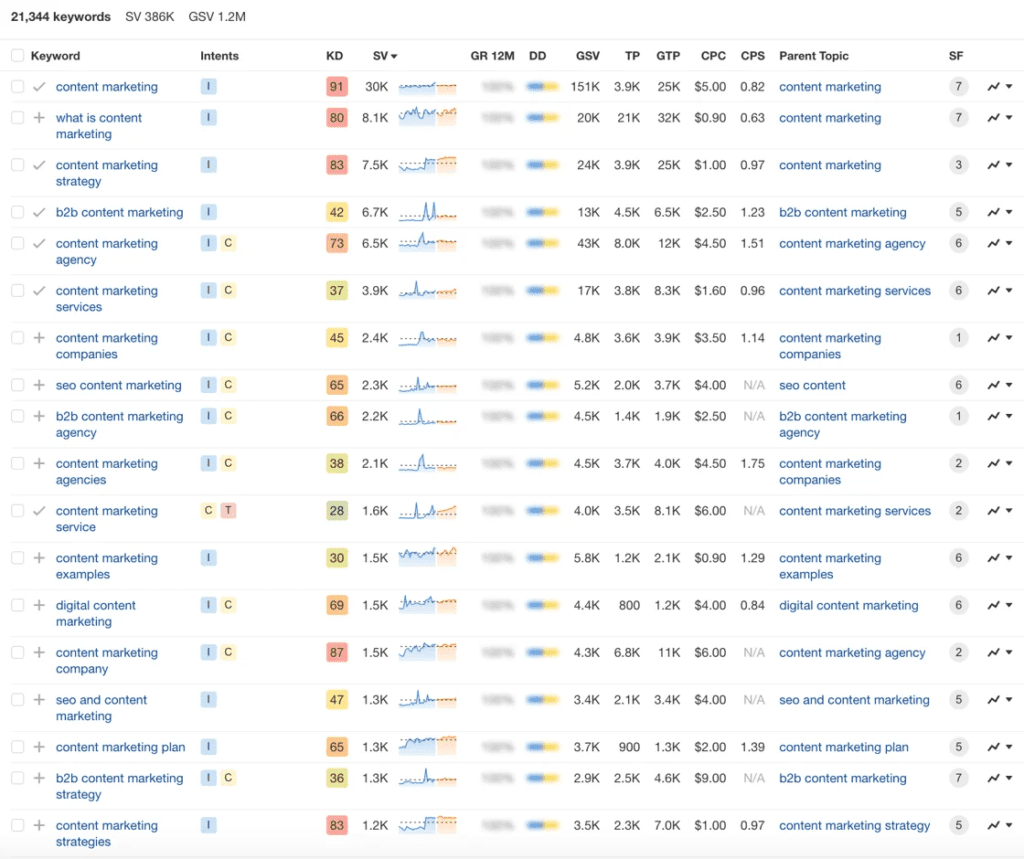

This is where you start with a big, broad term — think “CRM” or “content marketing” or “project management” — and use keyword explorer tools to extrapolate and expand the territory of related terms:

- Matching terms and close variants

- Question-based queries and PAA

- Modifier patterns (e.g., industry, feature, use case)

- SERP clustering to split distinct intents

You use this to build a scalable content framework. A kind of SEO architecture.

- Head term pillar: “What is [X]?”

- Modifier pages: “[X] for [Y]”

- Listicles: “Best [X] tools for [Y]”

- Alternatives pages: “[competitor] alternatives”

- Integrations: “[X] + [Y] integration”

There are tons of tools that help with this, too, from Ahrefs’ keywords explorer to Keywords Everywhere to AlsoAsked to AnswerThePublic (which I can’t say I’ve used since the Neil Patel acquisition, but got good mileage from throughout my career).

If you’ve conducted these two methods comprehensively, and then diligently filtered and triangulated against business relevance and product utility, you’ve got a pretty decent SEO roadmap in the works.

Still, however, it’s incomplete, identifying what’s already legible, and not what is whispered in conference hall lobby bars or bouncing around your prospects minds (and in their ChatGPT instances).

Bottom-Up: From Voice of Customer to Experiential Fruition

Now, this is the fun stuff, albeit much messier.

You start not with the tool, but with the customer, uncovering their under-met needs.

You mine for raw language, problems, desires, and emotional weight, and then translate that back into structured organic growth ideas. It’s qualitative research → strategic synthesis → SEO planning.

There are many ways to peel this potato. Here are three approaches we can use here:

1. Buyer Research: Strategic Empathy in Action

We run interviews, listen to sales calls, conduct surveys, and sometimes just talk to users. It’s a massive part of our strategic process and deliverables (as well as how we orchestrate content systems for clients and center our work around true SME experience).

The way someone describes a problem often holds the seed of a perfect page, whether or not it shows up in a keyword tool.

Now, the broad bucket of customer research warrants not just a separate newsletter essay, but likely a whole book. But there are some pretty simple ways you can get started.

For instance, your customer-facing teams (sales, support) already have a ton of this data. Mine, analyze, synthesize, and incorporate it into your other keyword research.

Or, if you get a chance to talk to a customer or two, ask them, “How did you try to solve this before you found our product?” That’s where you get true bottom-funnel phraseology — weird long-tails, misconceptions, job-to-be-done language.

And often, that’s where the best SEO ideas are hiding.

2. Community and Forum Mining: The Lobby Bar Effect

You’d be surprised what Reddit can teach you.

Go find a subreddit or forum where your ICP vents — SaaS founders talking churn, project managers talking burnout, ecomm operators talking attribution hell.

You get a lot of truth in these places, as well as nascent, emerging, rising topics.

We call this “lobby bar research.”

People are less polished, more candid. They share the real talk: the messy, contradictory, emotionally loaded stuff that never shows up in the sanitized world of “search volume.”

Our talented organic growth strategist, Usman, explained how he did this for a current client:

“We started with a broad topic query (e.g., “EV charger installation cost”) and appended “Reddit” in Google. Using the Ahrefs browser extension, we scanned Reddit threads directly in the SERPs, prioritizing ones that pulled decent organic traffic, a proxy for visibility and relevance.

Once we found high-traffic threads, we checked which keywords each was ranking for. This revealed the kinds of real, search-surfacing questions people were asking, things like “how to charge an electric car at home” or “how much does it cost to install a Level 2 charger.”

These insights gave us bottom-up validation. Not just that a topic mattered, but how people phrased it, what misconceptions they had, and which specific subtopics were driving attention. All of this fed into our broader content roadmap.

It’s manual, sure. But Reddit surfaces the kind of raw, emotional language that rarely shows up in keyword tools, making it a goldmine for building content that maps to the way real people think and search.”

I include, here, any pond where your ideal fish are hanging out in their natural habitat, including actual lobby bars, and *gasp* IRL meetups and coffees (yes, there’s value in putting down the laptop).

But also Slack groups and all the digital watercoolers out there.

There are also tools that purport to help you extract keyword ideas from Reddit and the like, though I prefer the manual right (with a little bit of web scraping and LLM interaction and cleanup).

3. GPT Expansion and Semantic Synthesis

Once you’ve got raw data (phrases, themes, pain points, full transcripts), you can scale the ideation process with a Custom GPT.

We feed it customer interview transcriptions, voice-of-customer snippets, positioning docs, product spec sheets, persona artifacts, even our own notes.

Then come the prompts:

- “What are 25 questions someone evaluating this product might ask?”

- “What use case-specific modifiers would apply to this feature set?”

- “What are TOFU, MOFU, and BOFU variants of this core theme?”

Honestly, it’s not about the prompt. I have no secret prompt. Vibe with it. Ask it questions in natural language, push it a little bit, see what it comes up with. Filter later.

Another talented organic growth strategist at Omniscient, Jill, explained to me how she used this method to fill out a massive annual roadmap plan for a fortune 500 client:

The goal was to surface high-impact keyword opportunities across multiple buyer personas and verticals, think strategic procurement leads, commercial buyers, and public sector stakeholders, and map them to both product value props and search intent.

Here’s the condensed playbook:

Ingest Internal Docs

We fed a Custom GPT everything we had: ICP decks, product fact sheets, segment models, and meeting notes. This gave the model real context.

Prompt for Brainstorms

Then we ran structured prompts by persona and value theme:

- “What are 100 short-tail keywords about cost reduction relevant to [product]?”

- “What might a dedicated buyer search for when evaluating vendors?”

We repeated this across clusters, iterating 3–5x to improve output quality.

Validate and Prioritize

Outputs were run through Ahrefs to assess volume and CPC, then gut-checked via SERP review. We tagged each keyword by cluster, buyer role, and audience segment.

Final Output

The result: a clean, prioritized keyword list tied to business impact, mapped by audience type, and ready for roadmap integration.

This workflow took what would have been dozens of hours of manual brainstorming and made it scalable, without sacrificing strategic fidelity.

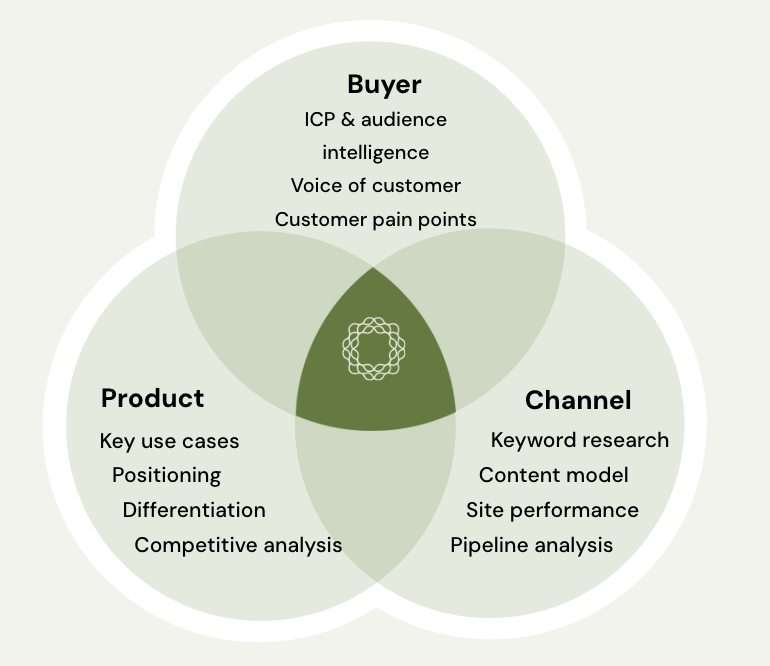

The Intersection of Validity and Visibility

What we’ve really been talking about here is opportunity surfacing.

Top-down gives you known opportunities — topics with measurable demand and visible SERPs.

Bottom-up gives you valid opportunities — topics with high signal relevance to your audience and product, even if your competitors haven’t picked up on them.

This was, by and large, the underlying motif in Eli Schwartz’s book Product Led SEO, which is a first principles take on how to build out organic programs:

“Product-led SEO is the concept of building a valuable product specifically for users. It’s not creating content because a keyword research tool tells you to; you’re telling a story about a product users want.

The difference is you’re creating content people want to read because you know they want it, not because you want rankings. The idea is to create something that helps users learn after clicking on your website. Beyond driving keywords, you’re building something of value.”

The trick, after collecting these potential opportunities from your audience, is to triangulate them with your product and channel data. That’s where our organic trifecta model (the Ikigai of SEO) comes in:

- Buyer research

- Product relevance

- Channel data

The center of the bullseye here is something that has buyer demand, product relevance, and propitious channel opportunity.

This is also where your filtering and sorting logic matters, deciding what’s an organic growth priority now, what belongs in the backlog, and what’s worth developing even without discernible MSV because it has latent LLM potential, customer journey utility or inherent value to your business, or conversion impact.

The Funnel Myth (and the Reality of the Messy Middle)

It’s fairly obvious that simplistic, three step models are not representative of reality, but are rather a clean and easily understandable abstraction that helps marketers make and justify decisions.

There’s no “top of the funnel” or “middle of the funnel,” really. They are words that we have made up, and like money, Myers Briggs categories, and market forces, it is only our collective agreement and belief that make these things “real.”

The map is not the territory, and all that.

So I’m not hating on constructivism or even these concepts specifically, as I’ve used them extensively, and I will continue to do so – mostly because it’s better to be understood if you want to get things done (unless you want to spend your life toiling at the proverbial nerds table, pedantically huffing and puffing about esoterica).

What I’m saying is that the simplistic funnel model can constrain our thinking to the point of limiting the impact of our organic growth program. Because, except for a few “obvious” BOFU surface areas and pages to create (categorical keywords, competitor comparisons, case studies), users have been shown to ping pong back and forth between stages, seemingly chaotically, in pursuit of information, emotional factors, gaps in knowledge that help them make their ultimate decision.

In reality, people don’t move linearly from “awareness” to “consideration” to “decision.”

Google actually published research on this in 2020 called the Messy Middle.

It’s the in-between zone where consumers loop through cycles of exploring options and evaluating them, often multiple times, before making a choice. They explore. They evaluate. They backtrack. They forget. They resurface. They cross-reference. They spiral, and sometimes irrationally, they decide.

Kevin Indig pulled from this research and used it to inform one of the better SEO takes, arguing that most site structures and content strategies don’t accommodate this behavior at all. They assume someone will land on a single blog post, consume it rationally, follow CTAs in order, and convert.

That’s not how it works.

That’s why top-down keyword research feels so incomplete, it optimizes for the mythical, rational journey instead of the reality of context and decision making. It assumes a keyword maps cleanly to an isolated experience.

That’s also why bottom-up research, where you talk to real people and hear how they stumble through their journey, feels so revelatory. You can actually begin to uncover some of those gaps represented by the messy middle and begin to solve for them, even if, and perhaps especially if, those touchpoints are not simple product pages or blog posts on your website.

In fact, what you’ll realize very quickly is that your blog content is important, but it has been treated as an isolated library, whereas it’s typically one small node in a system made up of WhatsApp groups, communities (IRL and digital), review sites, forums, press, case studies, and LLM conversations, and each of these can be a meaningful touchpoint influenceable by smart organic growth efforts.

And this is where the Surround Sound Strategy becomes so powerful.

Because in the Messy Middle, it’s not usually about a single best article. It’s about ubiquity or omnipresence within a given surface area of influence.

If your brand shows up in the blog post, the listicle, the Reddit thread, the podcast episode, the G2 grid, the YouTube video, and the LinkedIn comment thread, you’re no longer just an option, you become the default.

And this brings us to GEO / AEO (whatever).

Why This Matters (Even More Now)

In the LLM-powered search world, your audience isn’t just typing a two word head term into a box, they’re having a multi-prompt conversation. They’re uploading context documents and including highly specific consideration criteria to personalize recommendations. They’re asking nuanced, layered questions.

In other words, they’re not just typing “best CRM” and running with the top ten results.

But if you’ve written something specific, well-positioned, and clear about who it’s for and what it solves, there’s a real chance you’ll be surfaced as the best-fit answer, even if you’re not ranking #1 on Google in the traditional sense.

Grow & Convert put together their thoughts on the differences, focusing heavily on user behavior differences, but also the preeminence of product marketing artifacts like positioning and messaging as a factor in how (and how often) you should up).

“When someone prompts an LLM, it scans the web and tries to find the best answer to that person’s highly specific question — pulling from the full context of the conversation — and then delivers the solution that best fits the need.

The companies that get recommended the most will be those that have published content that clearly articulates who they’re best for, what they’re best at, and why they’re better than the competition.

And this content has to be highly specific because the conversations people have with LLMs are highly specific. It can’t be generic. If your marketing site has similar copy, benefits, and use cases as every other competitor in your space, expect to stay lost in the shuffle.”

Ignoring for a second present-day limitations, the promise of this is great for users, and it’s great for brands, assuming they can do the hard work of truly differentiating and understanding their users.

So to pull this all back together:

Top-down keyword research is useful. It’s repeatable, it scales well, and it uncovers a ton of existing opportunity and gaps that are likely important to cover.

Bottom-up keyword research is messier, slower, but is often the basis of nascent opportunity identification, voice of customer insights, and differentiation and defensibility. Importantly, it actually maps to how people think and buy.

Want more insights like this? Subscribe to our Field Notes.