In the beginning was the keyword.

The keyword – the atomic unit of intent, or so we told ourselves. Pop a phrase into Ahrefs, accept the monthly-search-volume (MSV) reading as gospel, and scaffold strategy from there.

I remember when I first learned about Google’s keyword planner. It was my first job out of college. Then I got access to Moz (SEOMoz at the time). What a whirlwind! I could see topics, and how many people were searching for them. No longer did I have to take a shot in the dark when it came to content and SEO planning.

Except, we know that reality is a bit messier than that.

Independent audits peg MSV error rates anywhere from 40% to 70% on low-volume B2B queries. Toss in localization, seasonality, zero-click SERPs, and we were already sailing by a half-broken compass long before ChatGPT barged onto the deck.

Yet the fiction endured because it was legible, and because legibility fuels the Fisherian Runaway of B2B content, or what I’ve called SEO book reports.

If every marketer sees the same volume leaderboard, they chase the same terms, produce the same 4,000-word skyscrapers (adding a few floors with each competitive iteration), and congratulate each other on their “comprehensive” guides while users nod off and append “reddit” to their searches so they can find something honest and useful.

We reached a collective tipping point over the past five years where the majority of marketers began to denigrate “SEO content” as banal, regurgitated, sea of sameness.

However, I believe that’s not an inherent trait of creating experiences or content for users and their intent, but an emergent property of the data being too easy to pull, sort, copy, and converge into similar formats. Yes, the medium informs the message, but it doesn’t necessitate mediocrity. No one needs another “ultimate guide to marketing automation.”

From queries to incantations

Okay, so the world has changed. In the last few years, the search box started talking back.

Where a prospect once typed “best CRM for small businesses,” she now uploads a 14-page RFP and converses:

“I run a 21-person remote agency… $50k annual budget… must integrate with Slack and PandaDoc… show me options and revenue-forecast features.”

That’s less of a keyword, and more of an incantation—personalized, iterative, laced with private context. The output she receives is not ten blue links but a synthesized answer, cherry-picking documents, memory, and probability.

Not to mention the messy middle that occurs within one’s conversation with an AI – the small corrections, nudges, and iterations that get you closer to your ask.

- “Actually, could you prioritize tools that are AI native?”

- “Tell me more about [tool] and its biggest downsides. What do users complain about?”

- Does [company A] have case studies that relate to [my industry]?

Try modeling that with simple volume metrics. You’ll spend quarters labeling sand grains while the tide comes in.

Why chasing prompt volume would break us anyway

Suppose, by some miracle, a vendor delivered “accurate prompt volume,” at least to the point of being useful. It may happen.

We would likely do what we always do: sort descending, brief writers, reverse-engineer incumbents, crank up Clearscope. The sea of sameness would simply migrate from keywords to prompts, and the runaway would accelerate.

Good riddance. The absence of reliable prompt numbers is a forcing function to centering strategy on the one thing that reliably creates value: customers and their needs.. It compels us to trade shallow pattern-matching for deeper levers: unique advantage, lived expertise, proprietary data, triangulated insight.

Where’s the Alpha?

Alpha hides where spreadsheets fear to tread: inside the messy, idiosyncratic contours of your strengths, weaknesses, opportunities, threats. (Yes, that stodgy SWOT you ignored in business school.)

MasterClass broke into red-ocean SERPs by wielding advantages only it owned: SME video snippets (and transcripts) from world class instructors, a product-led funnel, and a war chest for links and paid surround-sound.

If you’re launching yet another CRM, the useful question is never “what high-volume term can we rank for?” It’s “what can we do that HubSpot can’t?” Sometimes the answer lies outside search, until you earn the brand, links, and data to fight on that terrain.

Topics, keywords, and the keyword universe

We switched from keywords to topics years ago.

In our client work, we’ll still often use head keywords as anchors for prioritization, namely because they are easy to communicate and understand and often present the broadest angle for coverage.

But embedded and within a head term are dozens of secondary keywords, and now, voice of customer data and prompt data, synthesized to comprehensively answer buyer questions as well as provide the context and cues to get picked up beyond the phrase match head term. And that’s within a page; a page also exists in a broader ecosystem of topic themes that branch across various questions and customer journey stages, ultimately mapping towards entities and authority.

I think most SEOs have at least implicitly made this shift.

HubSpot – who has since deleted the post, but your author has a strangely precise memory – wrote around 2015-2016 that one should prioritize “topics over keywords.” Thus, pillars, clusters, and content hubs aimed at building topical authority.

This shift far preceded LLMs, which have only accelerated the need for a new model.

Very recently, Kevin Indig wrote a big guide about this titled, “Keywords are dead. But the Keyword Universe Isn’t.”

This model also effectively roots itself in customer research and voice of customer phrases:

“A Keyword Universe is a big pool of language your target audience uses when they search that will help them find you. It surfaces the most important queries and phrases (ie, keywords) at the top and lives in a spreadsheet or database, like BigQuery.

Instead of hyperfocusing on specific keywords or doing a keyword sprint every so often, you need to build a keyword universe that you’ll explore and conquer across your site over time.”

Whatever model (or models) the industry converges upon, it’s obvious that the model built upon single keywords – each aligned with difficulties and broad user intents – is declining in utility as well as accuracy.

Triangulation: The Ikigai of SEO

Is keyword data useless? No. If we get good prompt data, would I ignore it? Also, no.

It’s still a valid data point, but it needs to be incorporated into a broader framework that includes your customers’ undermet needs and your unique product or service advantages.

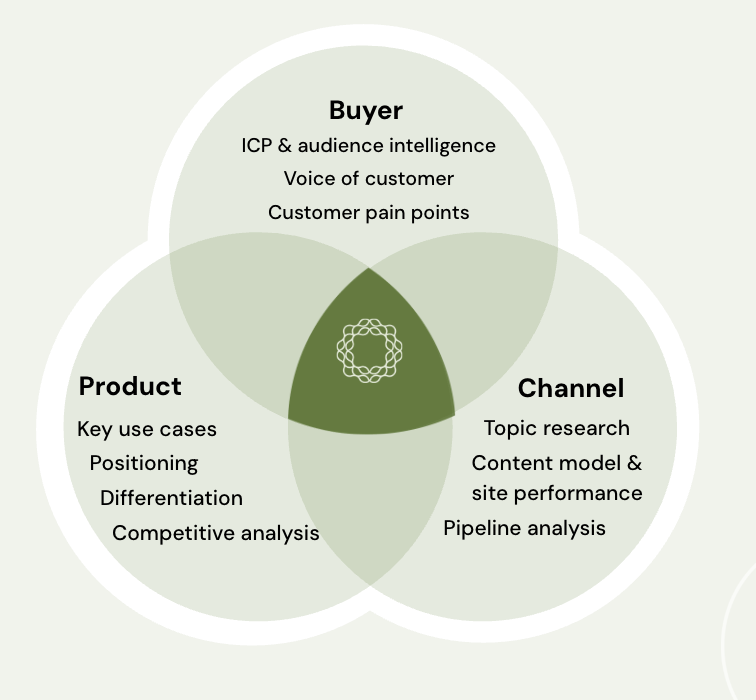

We run every client through a three-circle Venn: buyer, product, and channel. Where they overlap lies content worth making.

- Buyer research – Interviews, call transcripts, Reddit threads, Slack groups.

- Product – features, utilities, comparative advantage, jobs-to-be-done, categories.

- Channel data – Keywords, prompts, questions, intent, CPC, volume, etc.

No single dataset dictates the roadmap; the composite does. That is your ikigai, your defensible core.

Practical Playbook (Reader’s Digest Version)

- Interview a handful of customers this quarter. Extract exact language; feed it to your topic model. CustomGPTs are very useful here.

- Audit your unfair assets. Internal data, SMEs, contrarian worldview, unique go-to-market advantages. Choose one to index your organic strategy on..

- Map the messy middle: list the 10–15 third-party surfaces influencing your deal cycles and design a Surround-Sound sprint.

- Ship a costly signal. Think beyond keyword and topic arbitrage and launch something interesting. A mini-doc, a benchmark study, a founder-filmed teardown. Get people talking.

- Let MSV reports trail the convoy, not lead it. They still help size bets, but only after steps 1-4 give them meaning.

Want more insights like this? Subscribe to Field Notes